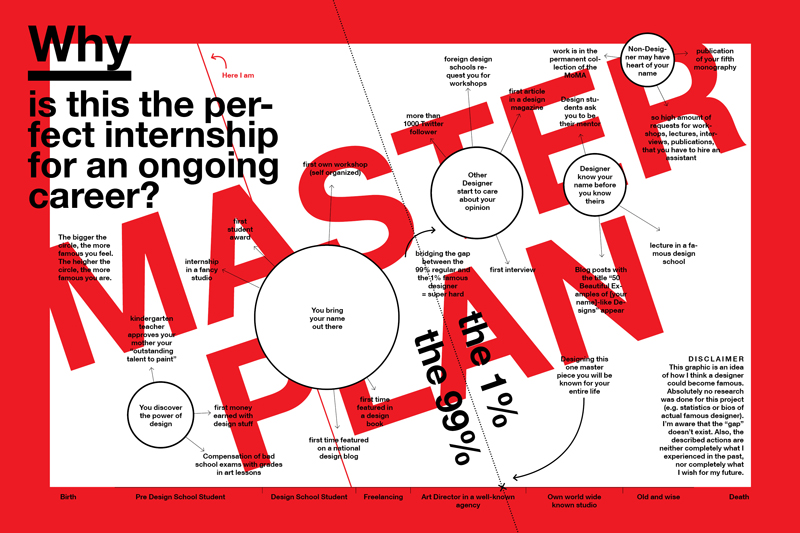

Gender Equity in the Coffee Value Chain: What Companies Are Doing to Close the GapDaily Coffee News by Roast Magazine

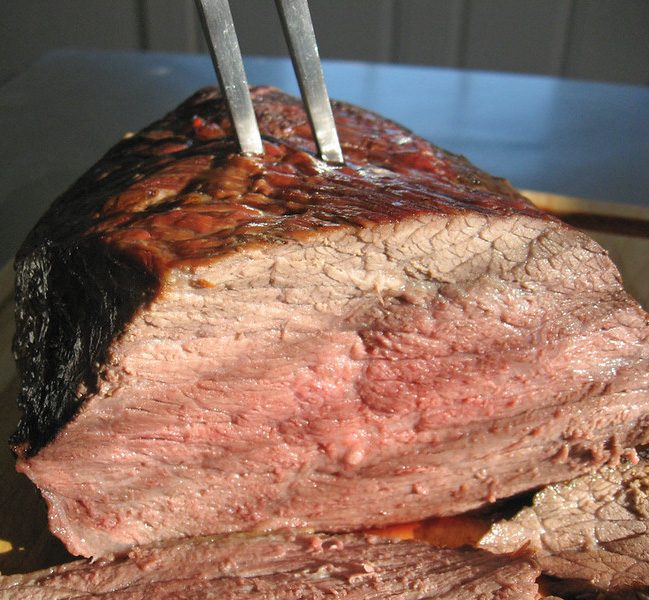

Instant Pot Eye of Round Roast :: paleo, GAPS, Whole30, keto | Recipes, Instapot recipes, Round roast

Healing diet holiday recipes (AIP, PALEO, SCD, GAPS) » BIOME ONBOARD AWARENESS: THE SCIENCE BEHIND FOOD, OUR MICROBIOME, AND DISEASE