VACLAV HAVEL, DE LA DISSIDENCE A LA PRESIDENCE | Prague czech republic, Václav havel, Heart of europe

V. Havel: Tento národ nezměním. Jsem ochoten sloužit tak dlouho, dokud budu schopen | Inspirational people, Mens tops, Václav havel

Okamžik zastiňující všechny ostatní.“ Před 30 lety se Tomáš Baťa vrátil do Československa — ČT24 — Česká televize

HM in the sapphire tiara, in 1996, with President Vaclav Havel, Prague. | Queen elizabeth, Elizabeth ii, Queen elizabeth ii

Vaclav Havel in Grevin museum of the wax figures in Prague. – Stock Editorial Photo © Pe3check #161470994

České rodiny: Baťovi, Bendovi, Foerstrovi, Havlovi, Holíkovi, Masarykovi, Nývltovi, Rottovi, Václav Havel, Tomáš Garrigue Masaryk | Amazon.com.br

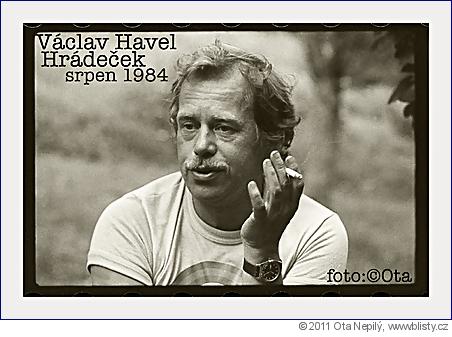

STOCK IMAGE, , FO00239531, 01AH87J7 , CTK Historical - Search Stock Photos, Images, Pictures, Photography at Diomedia

Vaclav Havel in Grevin museum of the wax figures in Prague. – Stock Editorial Photo © Pe3check #161471096