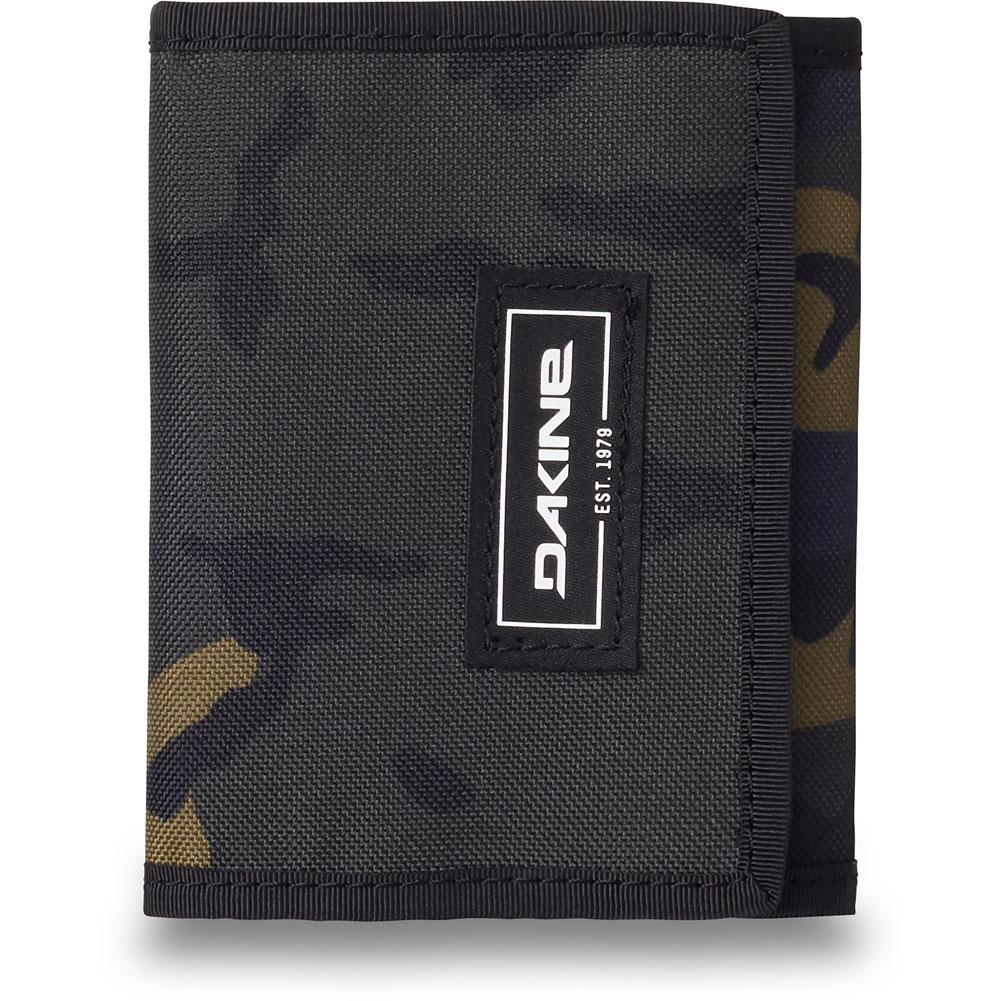

Ropa, zapatos, accesorios de hombre WALLET Dakine Diplomat Portway Purse Ripper Coins Notes Cards Identity NEW Blue Ropa, calzado y complementos EN4644835

WALLET Dakine Diplomat Portway Purse Ripper Coins Notes Cards Identity Blue US | eBay in 2022 | Coin purse, Dakine, Wallet

Large Men's Wallet DAKINE - Diplomat Wallet 10000435 Carbon - Men's wallets - Wallets - Leather goods - Accessories | efootwear.eu